We know that dental insurance can be a bit confusing, and we want to help you navigate this world with ease. We have put together this quick, informative guide to clear up misconceptions and provide you with a better understanding of dental insurance. There are exceptions to every rule, but in general, most dental insurance programs have a similar structure.

Understanding Dental Insurance Basics

First things first: dental insurance is a type of coverage that helps you pay for dental care. It typically covers preventive services (like cleanings and exams), basic procedures (like fillings), and sometimes more complex treatments (like root canals and crowns). Dental insurance plans usually involve a monthly premium, an annual maximum benefit, a deductible, and copays or coinsurance. Here’s a quick breakdown:

Monthly Premium: This is the amount you pay each month for your dental insurance coverage. It can vary depending on the plan and provider.

Annual Maximum Benefit: This is the maximum dollar amount your insurance will cover for dental care in a given year. Once you reach this limit, you’ll need to cover any additional costs out of pocket.

Deductible: This is the amount you must pay out of pocket before your insurance kicks in and starts covering costs. Deductibles typically reset each year.

Copays & Coinsurance: Copays are fixed amounts you pay for specific services (like a $25 copay for a dental cleaning), while coinsurance is a percentage of the cost you’re responsible for after meeting your deductible (like 20% of the cost of a filling).

Dental Insurance Terminology Explained

Navigating dental insurance can feel like learning a new language. Here are some essential terms you should know:

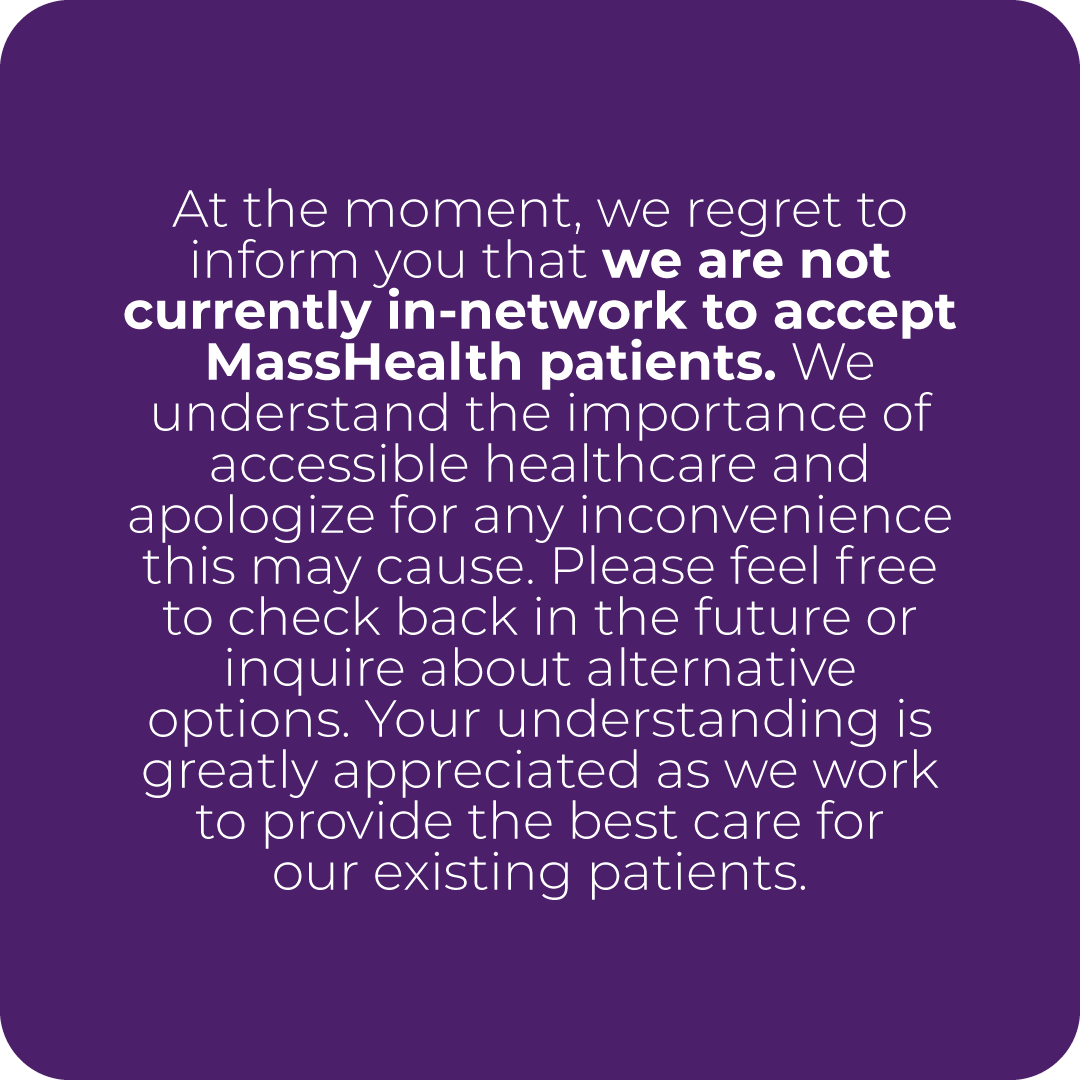

In-Network vs. Out-of-Network: In-network providers have negotiated discounted rates with your insurance company, while out-of-network providers haven’t. Typically, you’ll pay less for services from in-network providers. We are currently in network for general dentistry with Delta Dental, Blue Cross Blue Shield, Altus, Cigna and Metlife.

Preventive, Basic, and Major Services: Dental insurance plans usually categorize services into three tiers:

- Preventive services (e.g., cleanings, exams, and X-rays) are typically covered at 100%.

- Basic services (e.g., fillings, extractions, and periodontal treatment) may be covered at 50%-80%.

- Major services (e.g., crowns, bridges, and dentures) often have lower coverage rates, such as 50% or less.

Waiting Period: Some insurance plans require you to wait a certain amount of time after enrolling before you can use your benefits for specific services. For example, you might have to wait six months for basic services or a year for major services.

Some Lesser-Known Insurance Parameters Included in Some Plans

Missing tooth clause: Some plans have a clause which states that the plan will not cover the cost of replacing a tooth that was missing before the policy became effective. This means if you already had a missing tooth before obtaining dental insurance, your insurance may not cover the cost of a dental implant, bridge, or denture to replace that tooth. It’s important to review your policy carefully and be aware of any such clauses that could affect your coverage.

Composite/Crown Downgrade and Alternate Benefit Codes: Some dental insurance plans have a “composite/crown downgrade” provision, which means they may pay for a less expensive alternative treatment instead of the actual treatment provided by your dentist. For example, if you receive a composite (tooth-colored) filling or a porcelain crown, your insurance might only pay at the rate of an amalgam (metal) filling or a less expensive crown material. In this case, you would be responsible for the difference in cost between the two treatments.

It’s important to understand that even though your insurance pays less for the treatment you received, it does not mean the quality of the work is compromised. Your dentist will still provide the same high-quality care, using the best materials and techniques, regardless of what your insurance covers.

Tips for Maximizing Your Dental Insurance Benefits

To get the most out of your dental insurance, consider these tips:

- Stay In-Network: Whenever possible, choose an in-network provider to enjoy discounted rates and lower out-of-pocket costs.

- Schedule Regular Preventive Care Visits: Take advantage of your plan’s preventive coverage to maintain your oral health and catch potential problems early on.

- Understand Your Plan: Read your plan documents carefully to know what’s covered, any limitations, and your financial responsibilities. If you’re unsure about anything, don’t hesitate to ask your insurance company or our friendly office staff for clarification.

- Use It or Lose It: Since your annual maximum benefit doesn’t roll over to the next year, make sure to use your benefits before they expire. If you have pending dental work, plan it strategically to make the most of your coverage.

How Our Beyond Dental Health Can Help

We understand that dental insurance can be overwhelming, and we’re here to help you every step of the way. Our knowledgeable and friendly team is always ready to answer your questions, clarify any uncertainties, and provide guidance on maximizing your dental insurance benefits. Here’s how we can assist you:

- Insurance Verification: Provide us with your insurance information, and we’ll verify your coverage and benefits for you. We’ll help you understand what services are covered, any limitations, and your out-of-pocket costs.

- In-Network Provider: Check if our dental office is in-network with your insurance plan. If we’re in-network, you can enjoy discounted rates and lower out-of-pocket expenses.

- Treatment Planning: We’ll work closely with you to create a personalized treatment plan that takes your insurance coverage into account. We’ll help you make informed decisions and prioritize your dental care to maximize your benefits.

- Claims Processing: Our team will submit your dental insurance claims on your behalf, making the process hassle-free for you. We’ll ensure that all the necessary documentation is provided to your insurance company to expedite the processing of your claims.

- Payment Options: We understand that dental care can be a significant investment. In addition to working with your insurance, we offer various payment options, including Care Credit, to make dental care more accessible and affordable for our valued patients.

Non-Insurance Options: Beyond Dental Club

Don’t worry – for patient’s without insurance, we have a membership club, Beyond Dental Club, which helps you to pay for dental treatment, with instant benefits and discounts on treatment. For more information, check out our website: BeyondDentalClub.com.

Remember, our primary goal is to help you achieve and maintain optimal oral health. We’re committed to working with you to make the most of your dental insurance benefits while providing top-notch dental care that meets your needs and budget.

If you have any questions or concerns about your dental insurance, please don’t hesitate to reach out to our friendly team. We’re here to support you and make your dental experience as smooth and stress-free as possible. Keep smiling!